fsa health care vs hsa

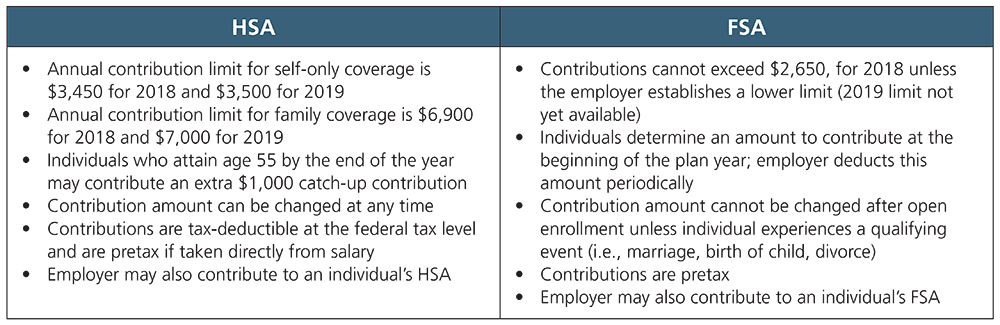

The HSA contribution limits are. To sign up for an HSA you also must be enrolled in a high-deductible health plan.

Can I Pay For Mental Health Care Using My Fsa Or Hsa

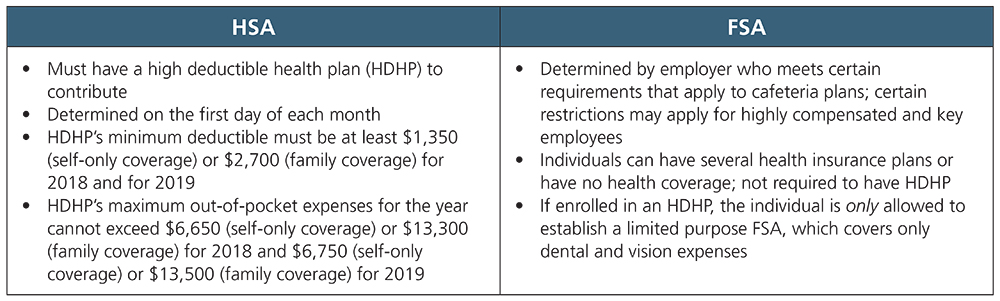

In terms of eligibility you are only eligible for an HSA under an HDHP or high deductible health plan.

. Here is a breakdown of how an FSA and HSA differ. The annual contribution limit is 3650 for an individual or 7300 per family. As previously mentioned this.

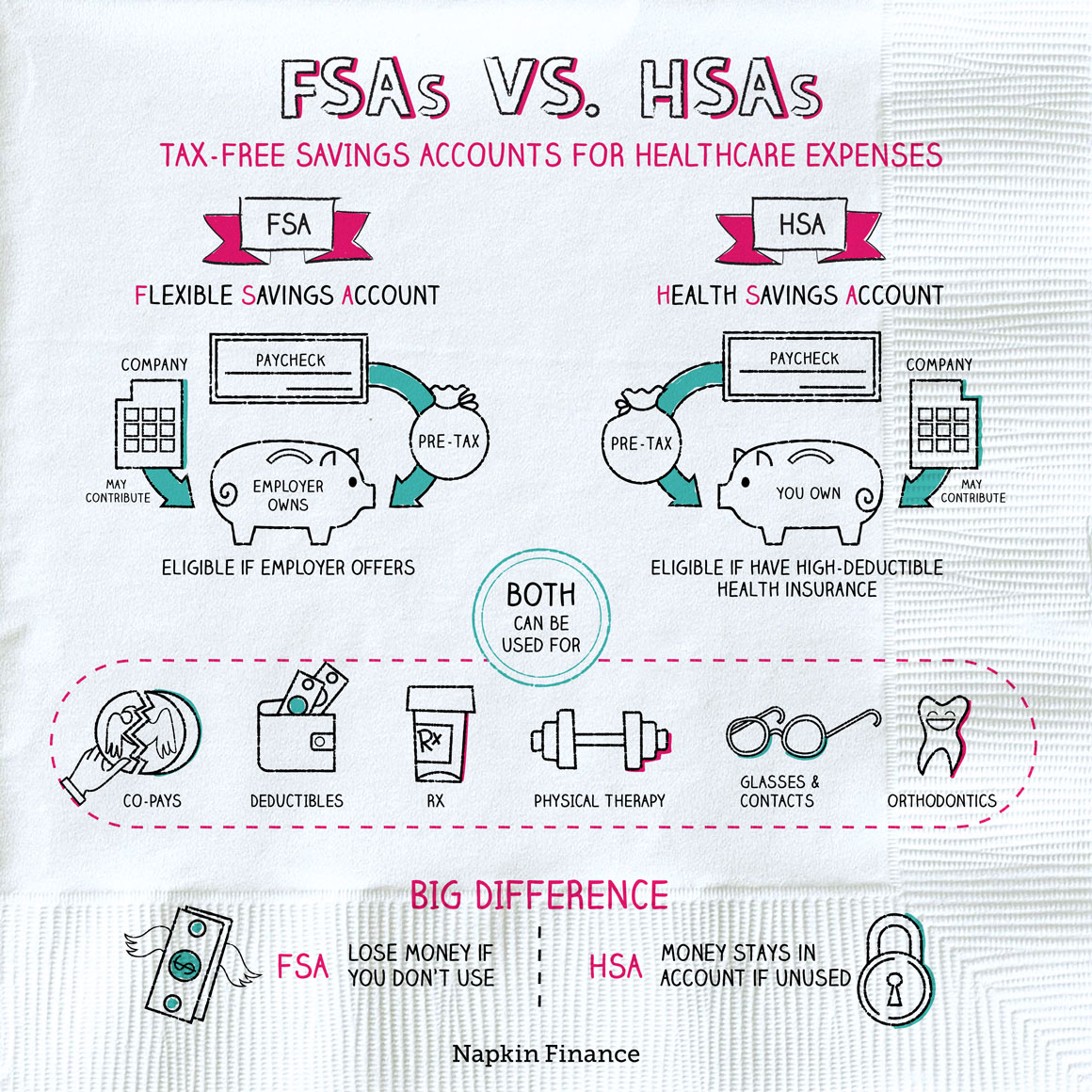

The HSA and Limited Purpose Health Care Flexible Spending Account FSAboth offer the opportunity to save tax-free money to pay eligible health care expenses. FSA is a flexible expenditure or arrangement account. HSA Health Care Flexible Spending Account Health Savings Account Medical Plan Option For any medical option except the Blue Cross 60 option Blue Cross 60 wHSA Employer.

There are notable differences between an HSA vs. Health savings accounts and flexible spending accounts offer two of the best ways to put aside money tax-free for health care expenses. You can have an.

Theyre called Health Savings Accounts HSAs and Flexible Spending Accounts FSAs. Unused funds will roll over. You dont have to worry about.

An HSA and FSA are both tax-advantaged accounts that let you stash your own money away for future health care costs. An HSA and FSA are both tax-advantaged accounts that let you stash your own money away for future health care costs. HSA is the account for health savings.

Both allow you to contribute on a pre-tax basis. A Flexible Spending Account FSA is a health care savings account that also lets you set aside money for out-of-pocket expenses just like the HSA does. HRA is an account or arrangement for health refund.

You dont have to be covered under a health insurance policy to be eligible but FSA funds are not an adequate substitute for health insurance. The FSA and HSA are two very different types of accounts with one significant similarity. You can open an HSA or FSA at.

A Health Savings Account HSA or a Flexible Spending Account. You can open an HSA or FSA at work if your. Workers can utilize their account funds to insure out-of-pocket medical.

HSA vs FSA. If you have one job you. HSAs and FSAs are tools you can use to hit two main objectives.

HSAs and health care FSAs have a lot in common including potential tax advantages. While an FSA and HSA both allow you to make contributions with pre-tax dollars an FSA is not the same as an HSA for tax purposes. An employee who has an HSA or FSA contributes pre-tax dollars to their understanding reducing their taxable income.

You also cant use an FSA to pay for. Two types of accounts can save you money on those out-of-pocket costs such as deductibles and co-payments. Saving up for health.

For 2021 you can contribute up to 2750 to a healthcare FSA. But theyre not interchangeable. Both FSA and HSA accounts are worth considering as they offer a tax-free way to save for medical expenses like medication childbirth physical therapy general medical exams.

For 2021 you can contribute up to 3600 for self-only up to 7200 for family. A health savings account HSA offers the.

Hsa Vs Fsa Accounts Side By Side Healthcare Comparison The Motley Fool

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

Hsa Vs Fsa Diagnosing The Differences Ascensus

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Hsa And Fsa Plan Savings Calculators Optum Financial

What S The Difference Between An Fsa And Hsa Forbes Advisor

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Hsa Vs Fsa The Difference Between A Health Savings Account Hsa And A Flexible Spending Account Fsa

![]()

Most Employees Don T Know Difference Between Fsa Hsa Survey Business Insurance

By Choosing An Hsa Hra Carefirst Bluecross Blueshield Facebook

Hsa Vs Fsa Vs Hra Healthcare Account Comparison

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Difference Between Fsa And Hsa Fsa Vs Hsa Which Is Better

Hsa S And Fsa S Why Companies Employees Should Participate Gro Hr Consulting

Fsa Vs Hsa Use It Or Lose It Napkin Finance

Hsa Vs Fsa What Is The Difference Between Them Aetna

Hsa Vs Fsa Diagnosing The Differences Ascensus