prince william county real estate tax payments

Press 1 to pay Personal Property Tax. Enter your payment card information.

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

If you have not received a tax bill.

. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. All you need is your tax account number and your checkbook or credit card. The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct.

At 930 pm the county announced its online. PERSONAL PROPERTY TAX PAYMENT AND PENALTY. Simply go to the Prince.

Its easy to pay your Virginia property taxes online using a credit or debit card. Prince William County Personal Property and Business Tangible taxes for 2022 are due October 5. Prince William County Tax Administration Division 1st FL 1 County Complex Court Woodbridge VA 22192-9201.

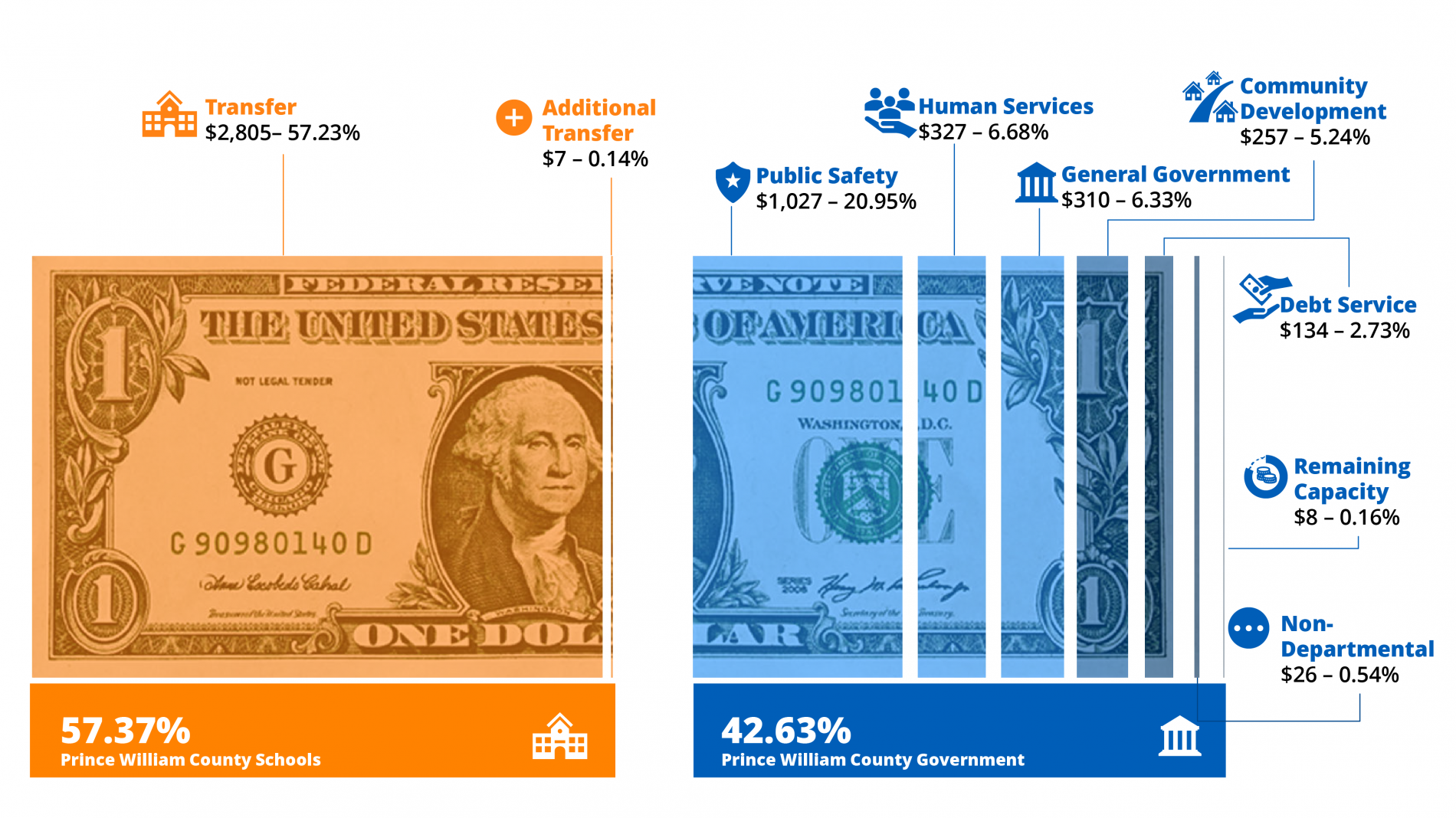

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Property taxes in Prince William County are due on June 5th and are paid to the Commissioner of the Revenue.

Payment by e-check is a free service. The real estate tax rate for the 2019 tax year is 120 per 100. The County bills and collects tax payments directly from these companies.

When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. The Oct 5th due date for the payment of business tangible and personal property taxes has been. Virginia Property Tax Car Pay Online Prince William County.

Due Date Extended to October 6th for Personal Property and Business Tangible Tax. By creating an account you will have access to balance and account information notifications etc. Tax Relief for the Elderly and Disabled Contact the Real Estate.

Learn all about Prince William County real estate tax. Finding the Amount of Property Taxes Paid. What is different for each county and state is the property tax rate.

If payment is late a. Due Date Extended to October 6th for Personal Property and Business Tangible Tax The Oct 5th due date for the payment of business tangible and personal property taxes has been. Enter the Account Number listed on the billing statement.

Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. You can pay a bill without logging in using this screen. There are several convenient ways property owners may make payments.

Access to Other Accounts. Prince William County collects on average 09 of a. Welcome to Prince William Countys Taxpayer Portal.

A convenience fee is added to payments by credit or debit card. Manage Access - Grant Revoke. Most homeowners pay their real estate taxes through a mortgage services company.

Those who waited until the last minute to pay their personal property taxes in Prince William County encountered problems. Press 2 to pay Real Estate Tax.

Prince William County Real Estate Taxes Due July 15 2022 Prince William Living

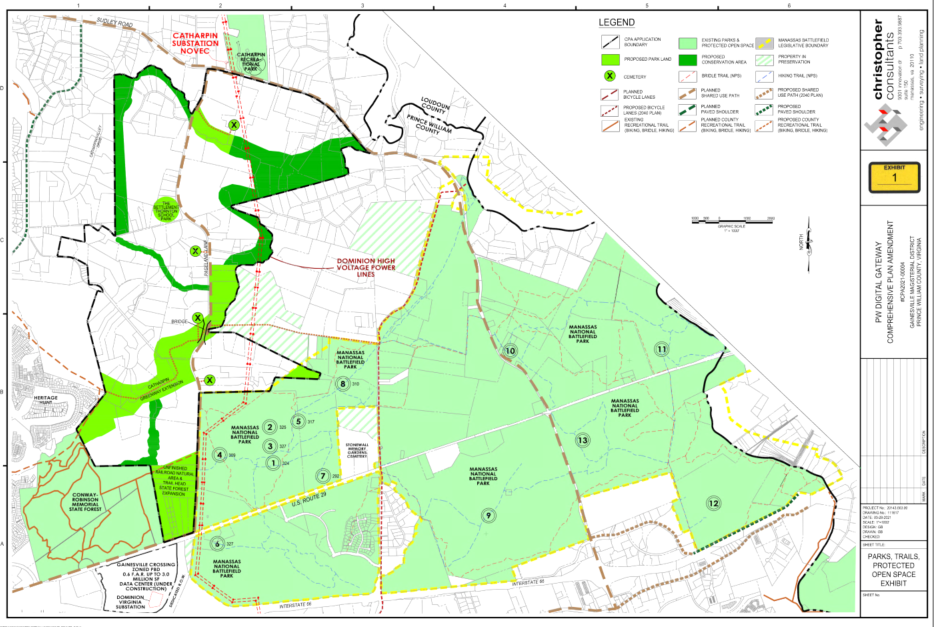

The Coalition To Protect Prince William County Unless Someone Like You Cares A Whole Awful Lot Nothing Is Going To Get Better It S Not The Lorax

The Rural Area In Prince William County

I Believe Prince William County Supervisor Pete Candland Facebook

Prince William County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Prince William County Considers Land Use Changes That Encourage Sprawl The Piedmont Environmental Council

Prince William County Public Schools Student Transfer Request Form Fill And Sign Printable Template Online Us Legal Forms

Prince William Considers Tax Hike On Data Center Equipment

Virginia Property Tax Calculator Smartasset

All Prince William Taxpayers Will Pay For Data Centers Built Near Schools Bristow Beat