working capital turnover ratio ideal

A higher ratio indicates a strong financial outlook for your. Working capital turnover ratio is an analytical tool used to calculate the number of net sales generated from investing one dollar of working capital.

How Much Working Capital Is Needed To Grow Your Business Pursuit

WC 100000 50000 WC 50000 Working Capital Turnover Ratio Net SalesWorking Capital 15000050000 31 or 31 or 3 Times This shows that for every 1.

. Working capital is to a business as wind is to a sailboat sure you might be able to drift along without it laboriously paddling to avoid the rocks but you really. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000. The working capital turnover ratio of Exide company is 214.

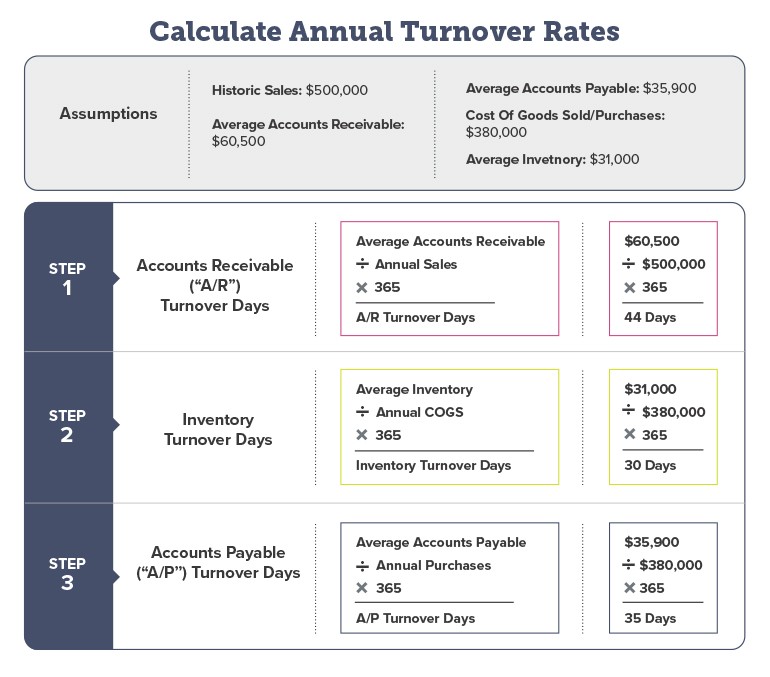

The formula to measure the working capital turnover ratio is as follows. Interpretation A working capital turnover ratio of 6 indicates that the company is generating 6 for every 1 of working. The goal here is to have a high ratio of working capital turnover.

What your Working Capital Turnover Ratio Means. High working capital turnover. The working capital turnover ratio denotes the ratio between a business net revenue or turnover and its working capital.

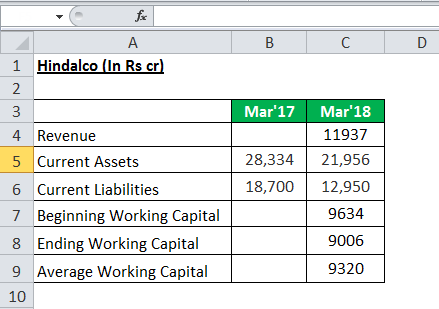

For example the working capital turnover ratio formula does not take into account unsatisfied employees or periods of recession both of which can influence a businesss. Working capital can be calculated by. The working capital turnover ratio will be 1200000200000 6.

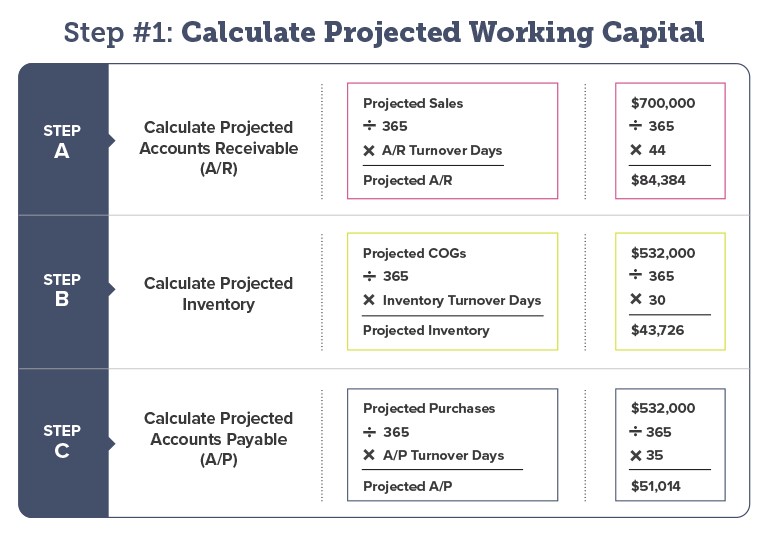

WC Turnover Ratio Revenue Average Working Capital. Working capital Turnover ratio Net Sales Working Capital And Net Sales Total Sales Sales Return Here Total Sales 500000 Sales Return 80000 Therefore Net Sales 500000. Ideal Working Capital Turnover Ratio Theoretically a higher value of this ratio would indicate a.

A higher working capital turnover ratio is better because it demonstrates that a business is generating higher sales per dollar spent. Published October 12 2015. However if working capital turnover rises.

What is working capital. Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a. Net Working Capital NWC 60000 80000 40000 5000 Since we now have the two necessary inputs to calculate the turnover ratio the remaining step is to divide net sales by.

In this case the Working Capital Turnover Ratio can be determined by the below formula. The calculation of its working capital. It means each dollar invested in working capital has contributed 214 towards total sales revenue.

A companys working capital turnover ratio can be negative when a companys current liabilities exceed its current assets. For example if a businesss annual turnover.

:max_bytes(150000):strip_icc():format(webp)/InvetoryturnoverfinalJPEGreal-5c8ff4fc46e0fb00014a975c.jpg)

Inventory Turnover Ratio In Retail How To Calculate And Improve It Dor

Working Capital Financing What It Is And How To Get It

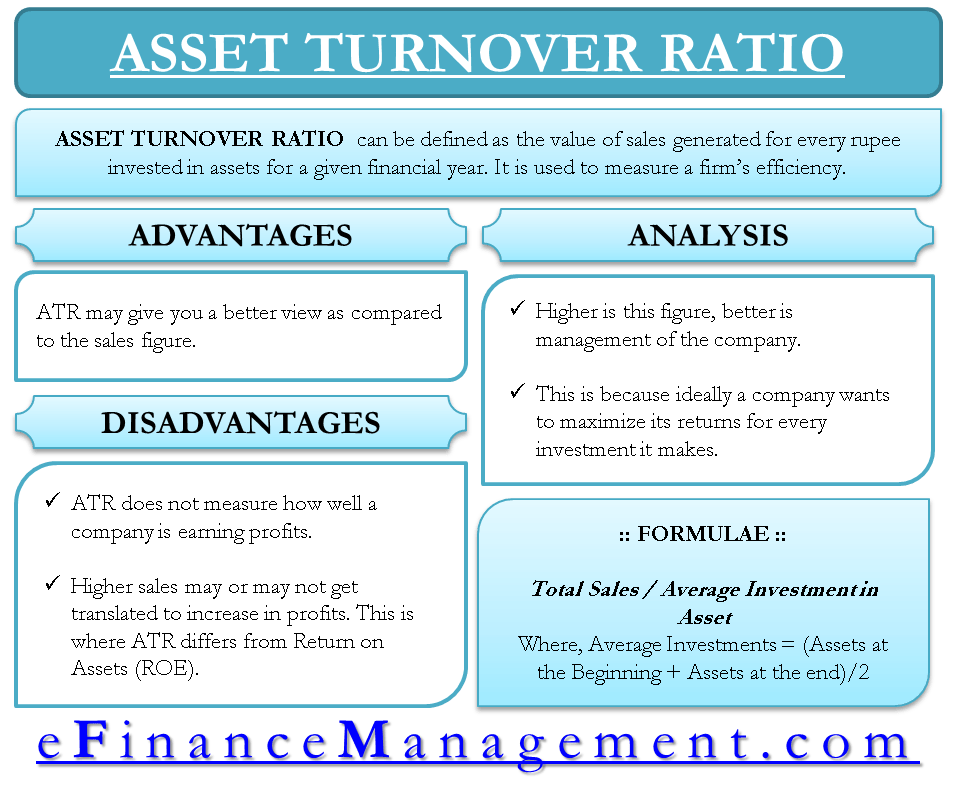

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Working Capital Management Acca Global

Working Capital Turnover Ratios Universal Cpa Review

How Much Working Capital Is Needed To Grow Your Business Pursuit

Working Capital Turnover Ratios Universal Cpa Review

What Is The Working Capital Turnover Ratio Quora

Working Capital Turnover Ratio Meaning Formula Calculation

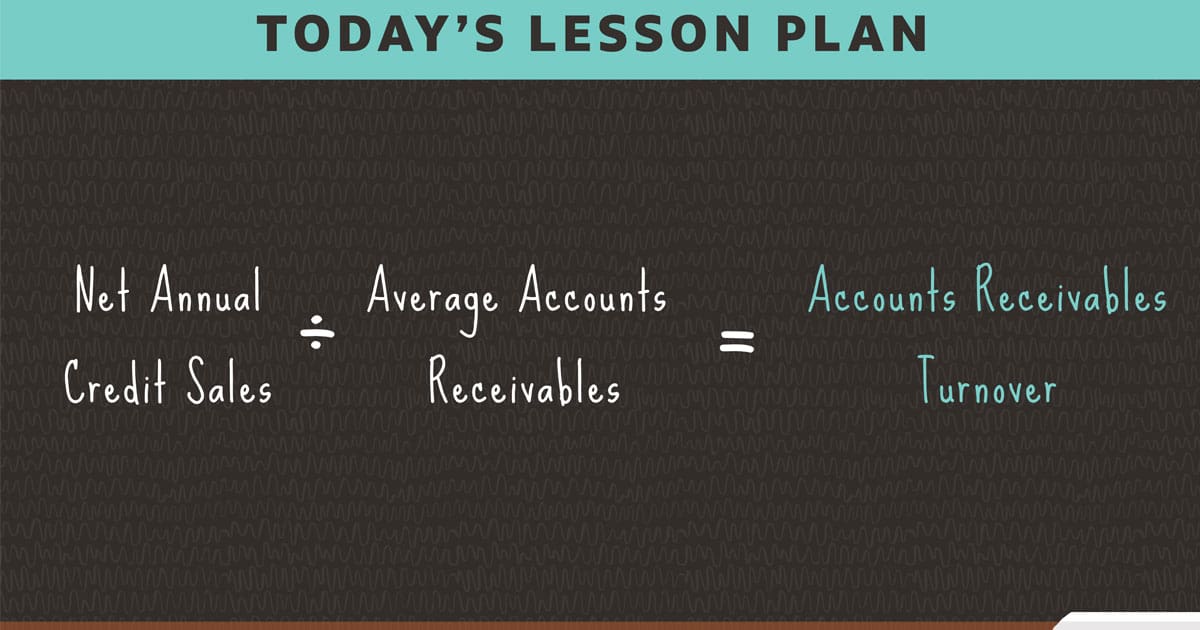

Accounts Receivable Turnover Ratio Definition Formula Examples Netsuite

Working Capital Turnover Ratio Formula Calculator Updated 2022

Working Capital Turnover Ratio Download High Quality Scientific Diagram

Working Capital Turnover Ratio Formula Example And Interpretation

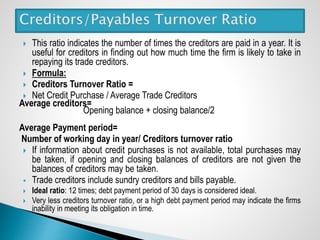

Ratio Analysis By Dr Suresh Vadde

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Example And Interpretation

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)